Cartography: Shen Yiling

Internet insurance, playing a little "hi", beware of the false innovation of "selling dog meat by hanging sheep’s head"

Not long ago, the stars Lu Han and Guan Xiaotong announced the news of their love affair, and the fans were boiling. Taobao merchants immediately began to sell "Lu Han Love Insurance", with a premium of 11.11 yuan per order. They promised that if Lu Han and Guan Xiaotong remained in a relationship one year later, the merchants would pay double the amount, and many fans actually took out insurance.

Nowadays, the online world is all-encompassing, and "wonderful" types of insurance emerge one after another: illegal sticker insurance, Xiong Haizi disaster insurance, helping the elderly to be wrongly insured, forgetting to wear long trousers insurance, beauty chef care insurance, gastrointestinal insurance and acne insurance … … There are so many kinds of insurance, only unexpected, nothing impossible.

Most Internet insurance fees are not high, and the cheap ones only need 1 yuan, and "Mao Mao Rain" is thrown at will; More than a hundred yuan, it doesn’t hurt to spend it. In addition, many types of insurance provide customized "packages", and WeChat and Alipay can transfer money. As a result, "my insurance is my master", which is personalized and disintermediated, makes it popular among more and more consumers, especially young people. According to statistics, more than 70% users of Internet insurance are young people from the post-80s to the post-90s.

However, for consumers, some internet insurance is actually not insurance!

First, there are suspicions of fraud and illegal fund-raising. Some types of insurance are not developed and sold by insurance institutions, and the policy has no legal effect. For example, the love insurance sold by a Taobao shop, "99 yuan, married after two years, presented wedding planning and a gift of 199 yuan; After three years of marriage, the amount of gift money has increased to 299 yuan. "It looks sweet, but in fact it hides risks — — The so-called insurance policy is just a piece of paper printed by the merchants themselves. If the merchants run away with the money after the insurance is sold, where can there be a gift to chase?

Zhu Minglai, a professor at the School of Finance of Nankai University, pointed out that at present, some traffic platforms illegally raise funds in the name of insurance, or scatter "bait" with high returns, or forge insurance policies to defraud consumers of funds. These platforms are not qualified as insurance agents. According to regulations, they can only provide customers’ recommendation, insurance price comparison and other services for both parties, but they are obviously selling illegally.

Second, there is a gambling nature, and "online insurance" may be online gambling. In the first two years, some regular insurance institutions sold smog insurance, World Cup regret insurance, pet pregnancy insurance, stock limit insurance and Mid-Autumn Festival moon viewing insurance. Experts pointed out that these insurance "targets" have no rules to follow, and the pricing and terms are not supported by risk data, which is no different from gambling. Fortunately, these "innovations" were all red cards in time by the regulatory authorities.

Third, the merchants are vague about the key information, and the product name is not true. Some Internet insurance clauses are unclear, the relevant information disclosure of insurance institutions is incomplete and inadequate, or the wealth management benefits are exaggerated, the nature of insurance products is weakened, or risk warnings are lacking. The exemption and compensation exemption clauses are ambiguous and misleading, which harms consumers’ rights and interests.

Seimi Zhang, a salesman of a private enterprise in Beijing, wants to insure a health insurance for his children. There is an insurance project on the Internet that 400 yuan can enjoy 300,000 yuan of general illness insurance coverage for an annual premium. He read the terms and conditions briefly and then took out the insurance. This year, his child was seriously ill, and the treatment and operation cost more than 100,000 yuan. When Seimi Zhang went to claim compensation, he discovered that he was insured with supplementary insurance for medical expenses. "Medical insurance reimbursed nearly 80% of the expenses, and I had to pay 24,000 yuan myself. According to the terms, the insurance company will also be exempted from paying 10,000 yuan, and finally only pay me 10,000 yuan. " Looking back at the terms, I found the existing explanations such as exemption and deductible, but they were all marked with relatively small font size. "The feeling is intentional, which makes people ignore these special explanations."

The fourth is the risk of loss or disclosure of personal information. The relevant person in charge of Taiping Life told the reporter that some companies are currently doing business with unqualified third-party network platforms. "It seems that the platform is docked with the insurance institution’s system. In fact, after insurance, insurance institutions still have to manually export insurance information, and then complete insurance through their own online sales, electronic sales or salesman direct sales. This online and offline disjointed operation mode cannot completely retain the insurance trajectory of consumers, and it is prone to misleading sales and difficult claims. " Insiders are worried that if some insurance companies put their customers’ private data on public "cloud" servers, or their own information systems are improperly maintained, it will lead to the disclosure of customers’ personal information.

Experts pointed out that at present, Internet insurance has just started and the market development is still not perfect. The "cheap conditions" such as network scene customization, small premium and technology application are double-edged swords for consumers. On the one hand, return insurance, mobile phone broken screen insurance and other insurance products with scientific pricing based on insurance principles have emerged, meeting the needs of multi-level and diversified risk protection. On the other hand, some "insurance innovations" that sell dog meat by hanging sheep’s heads take advantage of the network to fool and deceive consumers. Although the amount of each order is very low, it is not "high risk", but it is like "psoriasis" in the financial market, which makes people feel uncomfortable.

Not only are consumers easily fooled, but the risks faced by the insurance industry cannot be ignored.

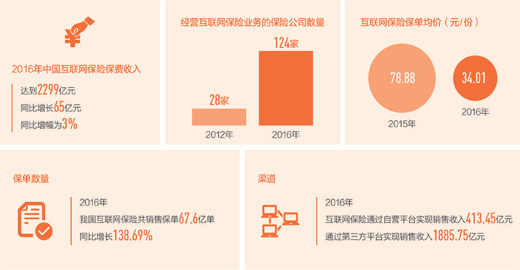

The data shows that in 2012— In 2016, China’s Internet premium income increased from 10.6 billion yuan to 229.9 billion yuan, an increase of more than 20 times; The number of insurance institutions operating Internet insurance business has grown from 28 to 124. Traditional insurance companies mostly carry out internet insurance business through self-built websites or cooperation with third-party platforms. The "insurance boom" of the network platform is unstoppable, and the mobile phone insurance APP software is even more dazzling.

But the risks are also lurking.

The most prominent problem is that the cooperation platform party does not have the qualification, which "causes trouble" to the insurance company. The relevant person in charge of Taiping Life Insurance pointed out that once there are systemic risk events such as collective default or run on these platforms, they will be transmitted back to insurance companies, which will have a serious impact on the operating performance and solvency of insurance companies in that year or even in the next few years. "Some insurance companies carry out credit guarantee insurance business with cooperative platforms, but the underwriting assets are more complicated and the risk exposure is too large." The person in charge said.

Secondly, fake insurance policies are repeatedly banned. The China Insurance Regulatory Commission (CIRC) recently reported a number of cases in which Internet small loan companies were suspected of fraudulently using the name of insurance companies and tying forged "accident liability insurance for small loans" policies to defraud victims of funds. Among them, Shanghai Tengwei Investment Management Co., Ltd., an institution involved in the case, has investors all over Guangdong, Jiangsu, Hebei and other provinces and cities, and the investment amount ranges from several thousand yuan to more than 100,000 yuan. The institution claims that its loan products are guaranteed by "Pacific Factoring Agency" and has also issued a "online payment account security liability insurance" policy to customers, but Pacific Property Insurance has never cooperated with this institution. Others make fakes and insurance companies lie down, and they have to bear the reputation risk of "damage is easy to repair".

There is also data pricing risk. The person in charge of Ping An’s "One Account Connect" believes that due to the lack of relevant historical data accumulation and application, Internet insurance may have a big deviation in the operation of innovative business. "The virtuality of the Internet itself will also produce various ‘ Pseudo data ’ , affecting accurate pricing. "

Information and technology security risks can not be ignored, including legal risks such as customer information leakage caused by improper online operation of employees, reputation risk caused by insufficient offline service ability, and sickness insurance caused by non-face-to-face transactions.

"In the Internet age, insurance operations can break through geographical restrictions and break down industry barriers. Once risks occur, they will spread quickly." Zhu Minglai believes that insurance products are naturally social and public welfare, especially internet insurance, which covers a wide range, with more than one billion new policies each year and a huge customer base. The negative impact caused by group surrender and claims disputes will not be limited to the economic field, but will also extend to the social field. "In addition, if Internet insurance always gives consumers the impression of ‘ Bo eyeball ’ ‘ Not reliable ’ That is undoubtedly destroying the development ecology of the industry and shaking the foundation of the development of the industry. This is the biggest risk of the industry. " Zhu Ming said.

Strengthen corporate responsibility, improve collaborative supervision, keep an eye on the "blacklist" and make good use of "big data"

"The insurance products in the Internet and mobile apps are very strange. How do I know who is real and who is fake? Taobao shop sells insurance. Is this under the control of CIRC or the Industrial and Commercial Bureau? If it is illegal, should the platform take responsibility? " Ms. Xu, an employee of a bank in Beijing, believes that Internet insurance is developing by leaps and bounds, and supervision should be strengthened.

On October 13th, 2016, the China Insurance Regulatory Commission issued the Implementation Plan for Special Remediation of Internet Insurance Risks, which warned against misleading behaviors such as misrepresentation, one-sided or exaggerated publicity of past performance, illegal promise of income, cooperation between insurance companies and third-party network platforms without business qualifications, and illegal Internet insurance business by non-licensed institutions.

"According to the existing regulatory framework, only licensed institutions can sell insurance, and only those that meet the core requirements such as actuarial laws ‘ Insurance ’ It can be called insurance, but the situation in the market is still quite serious. " Insiders pointed out that the Internet has a wide range of layers, and it is not possible to rely solely on a certain regulatory department to purify the Internet insurance market. It requires the coordinated governance of financial, industrial and commercial, information and other management departments.

As far as the insurance industry itself is concerned, the insiders believe that the following aspects can be "done right away":

"In terms of product development, no matter what the third-party platform proposes ‘ Brain hole ’ Insurance companies should follow the product development process and strictly control insurance risks; In terms of operation, establish an effective internal control system, strengthen the management of sales behavior, and ensure that the business is flawless and there are no major business risk events and reputation risk events. " Zhu Ming said.

The relevant person in charge of Taiping Life Insurance said that insurance institutions should resolutely stop cooperation with third-party platforms that do not have business qualifications and online lending platforms that provide credit enhancement services, set up fund pools and illegally raise funds. At the same time, consumers should be reminded to regularly check the product contents in industry associations or insurance companies in official website and obtain product information from formal channels.

"For underwriting risks, operational risks, information security risks, etc., we should improve the technical level and establish network security ‘ Moat ’ 。” Qiu Hui, deputy general manager of Ping An Health Insurance Technology Center, said, for example, intelligent analysis based on big data is carried out for product pricing, and accurate pricing is carried out according to multi-dimensional data such as history, region, market and reinsurance to ensure controllable risks; For operational risks, insurance companies should conduct strict process and authorization control through various authorization, upgrade and encryption systems to ensure that limited and authorized internal personnel can carry out specific operations; For external information access, sensitive data is limited to the customer by applying various intrusion detection, firewall, encryption and other technical means, and strict access control is carried out before, during and after the event to ensure information security.

Not long ago, SF Express made the sender and receiver "see the code but not the name" by scanning the code to prevent the customer information on the face sheet from being leaked. Insiders suggest that insurance companies should also form a closed-loop transaction with the help of third-party platforms, and customer information input, transfer payment, etc. are invisible to third parties.

How should the regulatory authorities plan ahead?

"The premise is to encourage innovation and reserve space for the healthy development of Internet insurance with an open and inclusive attitude. At the same time, effectively protect the rights and interests of consumers, focus on strengthening supervision in product development, information disclosure, information security, landing services and third-party platforms, and enhance the transparency of Internet insurance business. " Zhu Ming said.

Taiping Life suggested that regulators should strengthen the management and sharing of information on responsible subjects related to illegal and untrustworthy behaviors in the insurance field, and form a regular notification and publication mechanism, such as the blacklist of third-party online platforms for Internet insurance, so as to further strengthen the risk prevention and control of the insurance industry and effectively isolate the transmission of other risks.

In addition, the current industry data is scattered, which is divided into insurance companies, industry platforms, front-end customer APP import data, mid-end intermediaries, channels, claims, call data, back-end financial receipt and payment data, and so on, and there are many kinds and complexities. The insiders suggest that a big data platform should be established as soon as possible, the standards for data storage and transmission should be unified, and data from different systems should be opened, and then data mining should be carried out according to different needs, so as to strengthen the application of big data in anti-claims fraud and optimize products and services for the industry. Provide basic services.

关于作者