In recent years, nucleic acid drugs have become the key areas of global R&D and investment. Compared with traditional drugs for disease intervention at the protein level, nucleic acid drugs can play a role in the source of genetic information transmission, so they have the advantages of strong specificity, rich gene targets, lasting curative effect, etc., and avoid the complicated synthesis and purification process of traditional drugs, which can significantly reduce production costs.

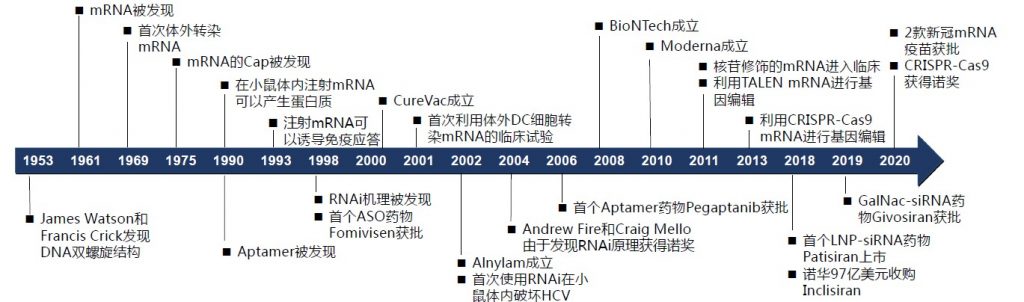

Since the discovery of DNA double helix structure in 1953, nucleic acid drugs have developed for 70 years, including antisense nucleic acid (ASO), small interfering RNA(siRNA), microRNA (mirna), small activating RNA(saRNA), messenger RNA(mRNA), aptamer, ribozyme, antibody nucleic acid-coupled drugs (RNA). Except for mRNA drugs, basically all other nucleic acid drugs are composed of single-stranded or double-stranded ribonucleotides or deoxynucleotide, so they are also called oligonucleotide or small nucleic acid drugs.

Different from the protein encoded by mRNA drugs, oligonucleotide drugs mainly pair with DNA, mRNA or pre-mRNA through the principle of base complementary pairing, and regulate gene expression through a series of mechanisms such as gene silencing, non-coding RNA inhibition and gene activation.

Time axis of nucleic acid drug development Source: Guosen Securities

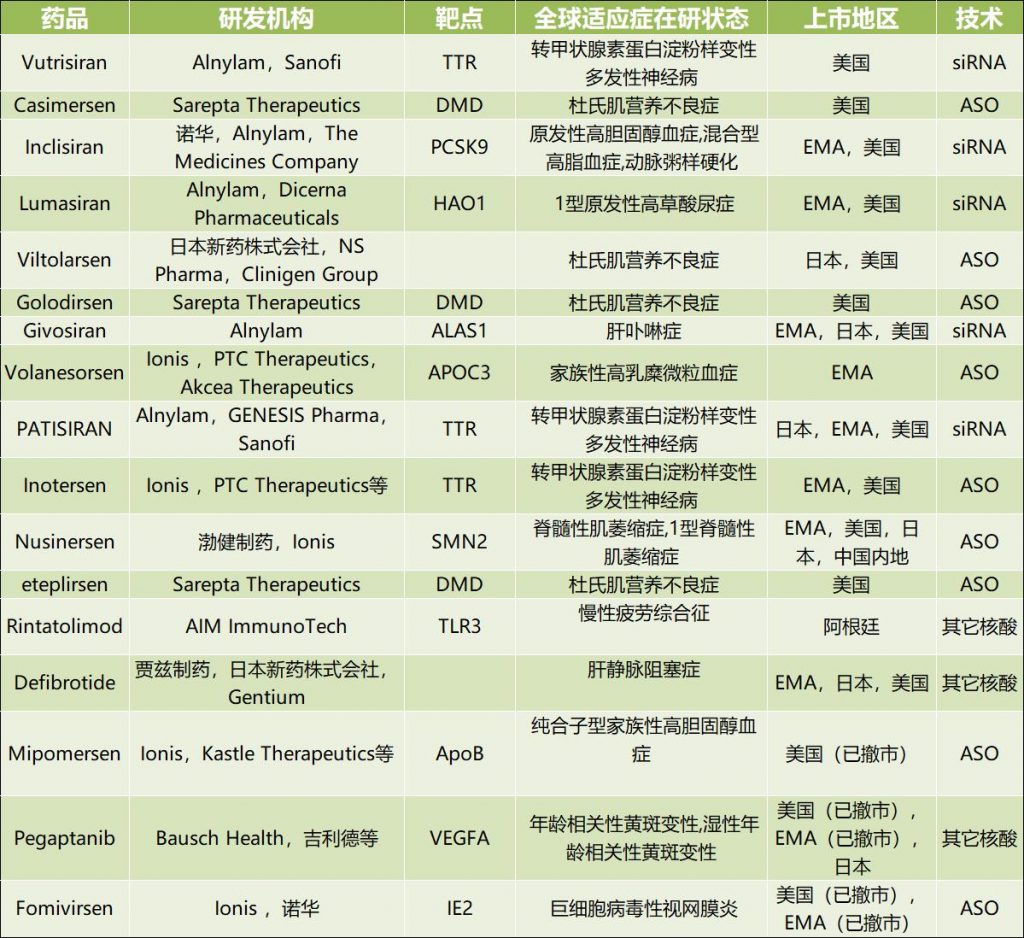

At present, there are 17 kinds of nucleic acid drugs listed in the world, and three kinds of them have applied for listing. There are 32 kinds, 115 kinds and 113 kinds of pipelines under research in Phase III, Phase II and Phase I respectively. Among 719 kinds of nucleic acid drugs in the world, ASO has the most varieties (253 kinds), and the rest are siRNA(229 kinds) and mRNA(72 kinds). TOP5, the leading companies in the global investment and distribution of nucleic acid drugs, are Ionis(91 models), Alnylam(34 models), simaomics(25 models), arrowhead (24 models) and AstraZeneca (18 models).

Sources of 17 nucleic acid drugs listed in the world: insights database

Because most of the nucleic acid drugs are oligonucleotides, oligonucleotides become important raw materials of nucleic acid drugs, and oligonucleotides are composed of dozens to dozens of nucleotides in series, so nucleoside monomers are also the key raw materials of nucleic acid drugs.

According to QYR’s forecast, in 2021, the global nucleotide market (including oligonucleotides and monomers) sales will be US$ 510 million, and China is the largest global nucleotide production market, accounting for about 55%. At present, the domestic market size of raw materials for nucleic acid drugs is estimated to be 280 million US dollars. In addition, the global demand for nucleotides is about 50,000 tons, and the annual output value of the domestic nucleotide market is about 27,500 tons. Most of them are exported to foreign countries, and the internal digestion ability used in the production of nucleic acid drugs in China is weak. Compared with the production of nucleic acid drugs in China, there is still a big gap abroad, which is not unrelated.

Because in general, 90% of the global nucleotides are used for the production of nucleic acid drugs, and only about 10% are used in health food, agriculture and other fields.

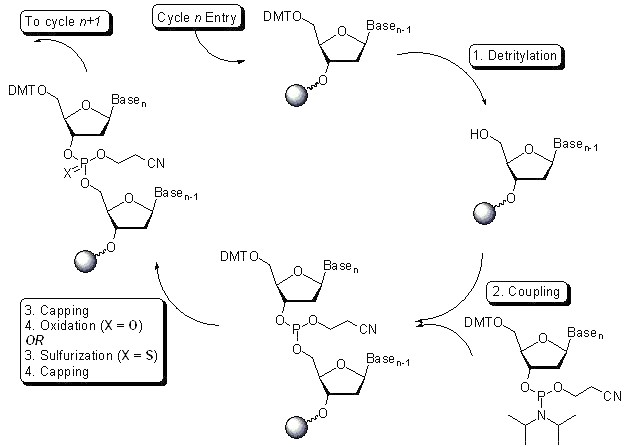

From the production process of oligonucleotide raw materials, the mainstream method for synthesizing oligonucleotides in the upstream process is the solid-phase phosphoramidite triester method, in which phosphoramidite monomer and solid-phase carrier are deprotected, coupled, oxidized, capped and other steps in a nucleic acid synthesizer to obtain the target base sequence, that is, the crude oligonucleotide, and then the crude oligonucleotide is deprotected and cut off from the solid-phase carrier, and the purity of the crude oligonucleotide is preliminarily detected by liquid chromatography, followed by purification, ultrafiltration, freeze-drying and other steps.

Taking DNA primer synthesis as an example, the following figure shows the steps of solid-phase phosphoryl synthesis. In the purification process, there are mainly reverse-phase chromatography (solid-phase synthesis-reverse-phase chromatography purification-demethylation-ethanol precipitation method-freeze-drying), ion-exchange chromatography (solid-phase synthesis-ion-exchange chromatography-concentration/deep filtration-freeze-drying) and hydrophobic chromatography combined with ion-exchange chromatography (solid-phase synthesis-hydrophobic chromatography-demethylation-ion exchange-UF/DF-API solution. In addition to the above chemical synthesis methods, other methods for preparing nucleotides include RNA enzymatic hydrolysis, microbial fermentation and biocatalysis.

Figure. Synthesis of primers by solid-phase phosphoryl method Source: Internet public information.

Oligonucleotides and nucleoside monomers are the key materials of nucleic acid APIs, and qualified suppliers that meet the quality requirements are rare all over the world. This is mainly due to the use of solid-phase synthesis technology in the production of nucleic acid APIs, which has high barriers in process development, process amplification and quality control, and the initial investment in solid-phase synthesis equipment and clean environment of nucleic acid APIs is very large, and the production needs to meet the international GMP requirements.

TOP10 giants, one of the few established qualified suppliers in the world, are Danaher Corporation (established in 1969), Merck KGAA (established in 1668), Eurofins Scientific SE (established in 1987) and Thermo Fisher Scientific Inc. (established in 2006). Agilent Technologies, Inc. (established in 1999), GE Healthcare (established in 1994), Kaneka Eurogentec S.A. (established in 1985), Gene Design, Inc. (established in 2000), LGC Bio Search Technologies (established in 1993), Bio-Synthesis Inc. (established in 1984)

There are about 160 suppliers of nucleotide raw materials in China, and their regional distribution is relatively scattered, including 43 enterprises in Shaanxi, 22 in Jiangsu, 21 in Hubei, 21 in Hubei, 20 in Shandong, 16 in Guangdong, 11 in Anhui, 6 in Zhejiang, 6 in Shanghai, 5 in Henan, 5 in Hunan, 3 in Tianjin and 2 in Shanxi.

Representatives of domestic oligonucleotide manufacturers are Guangzhou Ruibo, Hequan Pharmaceutical and Shanghai Zhaowei.

Guangzhou ruibo

Guangzhou Ruibo is a well-known CDMO company of oligonucleotide APIs in China. In 2013, it took the lead in establishing a large-scale oligonucleotide cGMP manufacturing workshop in China. In 2016, it obtained the license of oligonucleotide APIs production issued by CFDA, and it is also the only local enterprise that has obtained the license so far. In 2018, the construction of cGMP production base for oligonucleotide was completed, with an area of over 20,000 square meters, including 2,700 square meters of production workshop and 2,500 square meters of aseptic filling and finished product workshop. In mid-2019, a single batch of 1.8mol synthesis workshop with a purification capacity of 4,000L/h and a freeze-drying workshop of 1kg to 40kg can meet the commercial production demand of oligonucleotide APIs above the kilogram level.

Hequan pharmacy

In 2020, Hequan Pharmaceutical announced that its kilogram-level production workshop of oligonucleotide raw materials was officially put into operation, with an area of 2,800 square meters. Its oligonucleotide platform can support various types of oligonucleotide products, such as deoxyribonucleic acid (DNA), ribonucleic acid (RNA), morpholino antisense oligonucleotide (PMO) and polypeptide conjugated morpholino antisense oligonucleotide (PPMO). In July this year, another brand-new oligonucleotide and polypeptide production building of Hequan Pharmaceutical, located in Changzhou API R&D and production base, was also put into operation, including an oligonucleotide production workshop with an area of 2,840 square meters. After putting into production, Hequan Pharmaceutical will have four large-scale oligonucleotide production lines of kilogram class and more than 20 small-scale and medium-scale production lines, and the maximum total scale of single oligonucleotide synthesis will increase from 1.9mol to 6.0mol.

Zhaowei biology

Zhaowei Bio was established in 2001. It is one of the earlier enterprises in China engaged in R&D and production of nucleosides and modified nucleosides, and passed the ISO9000 quality management system certification in 2008. The company focuses on the field of nucleoside and nucleotide products, producing and selling various series of products such as modified nucleoside, nucleotide, phosphoramidite gene monomer, targeted tracer and biological enzyme. Zhaowei Bio, as a global large-scale manufacturer of oligonucleotides and gene monomers, can reach 7 billion doses of mRNA for nucleic acid vaccines at present, with a total output value of 1.5 billion in 2021. In July 2022, Zhaowei Bio invested 2.5 billion yuan in the research and development and production base of small nucleic acid drugs and settled in Hangzhou Bay, Shanghai.

From a global perspective, the overall supply of nucleotide raw materials is in short supply, and it still belongs to the global shortage of products. With the gradual release of clinical potential of nucleic acid drugs in the future, the related raw materials will be driven to continue to grow in the future, and the future prospect is good. As a domestic enterprise, we should focus on solving the technical research and development of innovative nucleic acid drugs, increase the ability of self-production and self-marketing, and grow into a leading nucleic acid drug enterprise on a par with international giants as soon as possible.

关于作者