Text |Car story fig

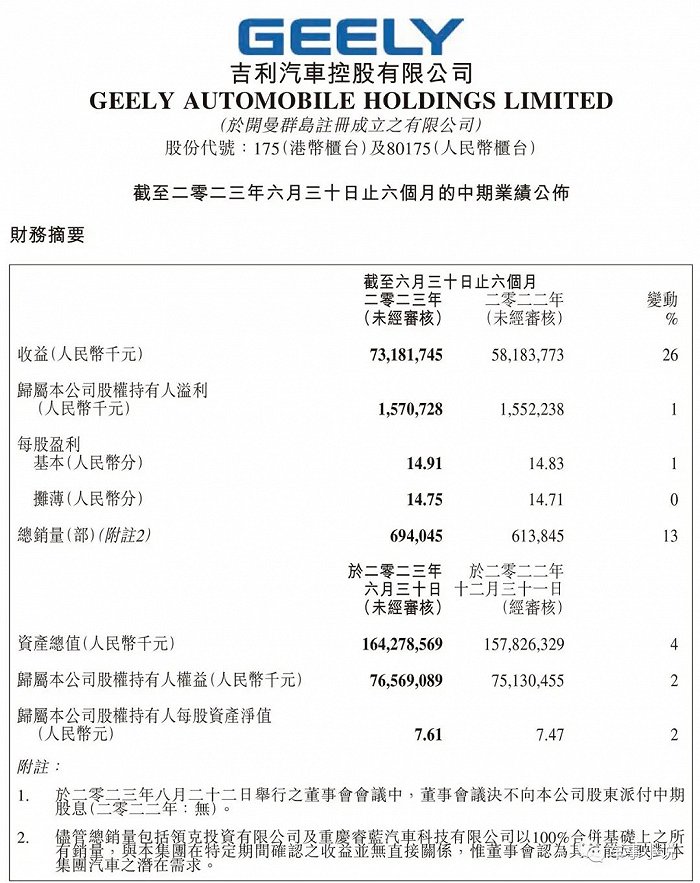

On August 22nd, Geely Automobile’s financial report for the first half of 2023 was officially released. According to the data of this financial report, in the first half of the year, Geely Automobile achieved a total revenue of 73.18 billion yuan, a year-on-year increase of 25.8%. The revenue also hit a new high in the same period of its history. The net profit was 1.571 billion yuan, a slight increase of 1% year-on-year. In the first half of the year, Geely Automobile’s gross profit margin was 14.4%. Compared with the same period last year, it decreased by 0.2 percentage points.

In the first half of the year, Geely Automobile achieved a total sales volume of 694,000 vehicles, a year-on-year increase of 13.1%. Among them, the export sales volume reached 121,000 vehicles, up 38.3% year-on-year, and the export accounted for 17.5%; The sales volume of new energy vehicles was 158,000, up 43.9% year-on-year, and the proportion of new energy vehicles was 22.7%.

Judging from the key data, Geely Automobile’s performance in the first half of the year is still good. Both revenue and sales growth have reached double digits.

Based on this, at the press conference of interim results report held on the same day, Dai Qing, CFO of Geely Automobile Group, said that Geely Automobile maintained its annual sales target of 1.65 million vehicles, of which the annual sales target was 140,000 vehicles.

(Source: screenshot of financial report)

From last year, Geely Automobile management’s comments on the interim results at that time were "not satisfactory" to this year’s "basically in line with expectations". In the past year, Geely Automobile has obviously made some progress in business. However, after carefully reading the above-mentioned financial report for the first half of the year, the car novel noticed that behind the superficial figures, the progress of Geely Automobile in the past year was not significant enough. In other words, simply from the financial report, Geely Automobile, a big ship, is still in the adjustment period because it is not completely aimed at the channel.

In terms of revenue, the first half of this year earned nearly 15 billion yuan more than the 58.184 billion yuan in the same period last year. However, in terms of net profit, it only increased by 19 million yuan compared with 1.552 billion yuan in the same period last year. The income has increased but the profit has hardly changed, which means that the operating cost has increased significantly or the unit price of products has decreased significantly.

According to the financial report, the sales cost of Geely Automobile in the first half of this year was 62.641 billion yuan, nearly 13 billion yuan more than the same period last year, with an increase of 26.02%.

In terms of breakdown, in the first half of this year, Geely Automobile’s administrative expenses were 4.867 billion yuan, an increase of 4.42% over the same period last year; The distribution and sales expenses were 4.768 billion yuan, an increase of 44.31% over the same period last year.

In this regard, Geely Automobile said in the financial report that despite the continued implementation of strict cost control, the increase in expenses caused by the transformation of new energy and the implementation of new sales business models to increase competitiveness still led to a significant increase in related expenses compared with the same period of last year.

(Source: car novel/photo)

Among them, in view of the substantial increase in distribution and sales expenses, Geely Automobile explained that it was mainly affected by the construction and operation of direct sales channels. The increase in administrative expenses is mainly due to vigorously developing and investing in new energy business.

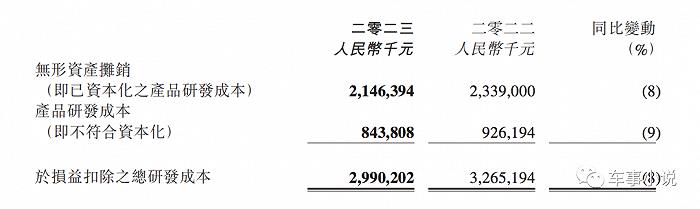

In terms of R&D expenditure, in the first half of this year, Geely Automobile spent 2.99 billion yuan, a slight decrease (9.20%) compared with 3.265 billion yuan in the same period last year. In this regard, Geely Automobile said in the financial report that most of the ongoing R&D projects are aimed at new products that have not yet been listed, so most of the related expenses have been capitalized and gradually amortized in the form of expenses only after the products are put on the market.

In the direction of R&D investment, Geely Automobile will continue to focus on the innovation of new energy vehicles and key technologies, especially forward-looking technologies such as intelligent interconnection and digitalization.

(Source: screenshot of financial report)

In addition, in the first half of this year, Geely Automobile’s expenditure on staff costs (including directors’ remuneration) also increased by 27.54% compared with the same period last year.

Regarding "cost control", Gan Jiayue, CEO of Geely Automobile Group and executive director of Geely Automobile Holdings Co., Ltd., said at the press conference of the interim results report that "Geely’s cost supply chain system is very strong. From the perspective of the whole value chain, if the scale effect cannot be formed, the enterprise will lose all opportunities".

In addition to the increase in expenses and costs, the losses of Geely Automobile’s Link and Krypton in the first half of this year also affected Geely Automobile’s gross profit margin.

According to the financial report, in the first half of this year, Lectra achieved a sales volume of 82,000 vehicles, a year-on-year increase of 6.2%. In addition to the domestic market, as of the first half of this year, Lectra has also entered the markets of the Netherlands, France, Italy, Germany, Sweden, Belgium, Spain and other countries.

However, contrary to the positive growth of sales, in terms of financial books, Lectra failed to bring positive growth. According to the financial report data, in the first half of the year, Lectra achieved a net loss of 660 million yuan.

In this regard, Geely Automobile explained that the main reason for the decline in Lectra’s performance was the massive investment in accelerating the transformation of new energy and the business expansion of Lectra in the European market.

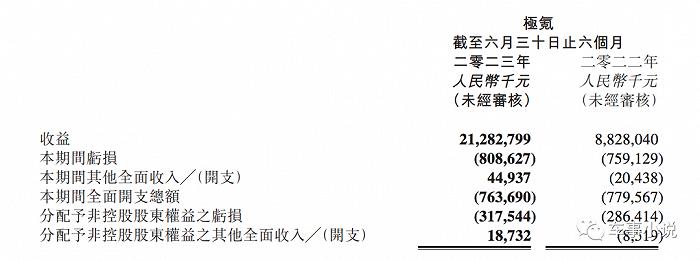

(Source: screenshot of financial report)

In addition to the Lexus, Krypton Motors also continued to lose money in the financial aspect in the first half of the year. According to the financial report data, in the first half of the year, the net loss of Extreme Krypton Automobile reached 810 million yuan.

In terms of market performance, the company delivered a total of 42,000 vehicles in the first half of the year, up 124% year-on-year. In the pure electric market of more than 300,000 yuan, the krypton market share accounts for 27.4%. Among them, the average order amount of Extreme Krypton 001 exceeds 336,000 yuan; The evaluation order amount of Krypton 009 reached 527,000 yuan. From the market point of view, the performance of Krypton cars is not bad.

However, based on the direct terminal sales model and the construction of the full-scene charging and recharging service system, the existing sales scale is obviously difficult to support the financial profitability.

In this regard, An Conghui, CEO of Extreme Smart Technology, said in the interim results report that there are only three models at present. With the launch of other products with vast architecture, the scale effect will be rapidly formed, and he is more confident in reducing costs. According to its disclosure, a brand-new car will be launched this year, and two brand-new SUVs will be launched next year. All three brand-new products will cover mainstream market segments. In An Conghui’s view, "the scale of sales (of extremely krypton cars) will definitely rise, with the same scale and higher gross profit, which is our consideration of the quality of operation."

For the extremely low price, An Conghui said at the press conference that "some rights and interests were offset by cash, which had little impact on gross profit". An Conghui said, "(using cash to deduct rights and interests) so that the user’s choice of opening will increase. From the current point of view, it has achieved good results and orders have been greatly improved. "

In response to the progress of the extremely embarrassing IPO, An Conghui said that the capital market is changing rapidly and will continue to track the dynamics of the capital market and choose the right window to go public.

According to a report by Cailian, Krypton plans to open a new round of water testing meeting with investors at the end of August, and plans to raise about $1 billion in IPO in the future.

According to the financial report data, as of the first half of the year, there were 306 directly operated stores (including offline stores such as Extreme Center, Extreme Space and Delivery Center), covering 75 cities across the country. In terms of recharging charging stations, 750 krypton charging stations have been built in more than 120 cities across the country.

In the second half of the year, six new models will be launched at the new product level. Among them, Geely brand will launch four models: Geely Yinhe L6 (a compact plug-in hybrid car developed based on CMA architecture and Raytheon hybrid system), Geely Yinhe E8 (a pure electric car developed based on pure electric modular infrastructure), and Jixing series (a new hybrid version of Xingyue L and a new hybrid version of Xingrui L).

Krypton will launch a pure electric car based on the vast platform (SEA) in the second half of the year. Lectra will launch Lectra 08.

For the next outlook, Geely Automobile believes in the financial report that although the growth rate of the new energy vehicle market has slowed down, it still believes that it has great development potential and opportunities. The above-mentioned upcoming hybrid and pure electric vehicles will bring new growth opportunities. In addition, we will continue to optimize the product portfolio of fuel vehicles and launch a small number of strategic upgrade models to stimulate market demand. At the same time, it will also strengthen cost control to ensure that the fuel vehicle business continues to be stable and profitable.

In this regard, Gui Shengyue, CEO of Geely Automobile Holdings Co., Ltd. said that with the listing of Geely Galaxy products, all brands under Geely Automobile have sounded the horn of comprehensive transformation to new energy. With the gradual deepening of the "all-round to new" strategy, Geely Automobile has completely completed the basic investment and ecological construction in the transformation to new energy, and its products have also completed the process of intelligent transformation. In the brand-new market competition pattern, Geely Automobile is expected to take off for the second time.

However, Geely Automobile also said in the financial report that the Group is in a critical period of transition to new energy sources, and the management level still faces various challenges in the transition period.

关于作者