On December 9th, Shaanxi Provincial Public Resources Trading Center issued the "Publicity on the results of the proposed selection of pacemakers in the centralized procurement of pacemakers in provincial alliances (regions and corps)" (hereinafter referred to as "Publicity").

Review of pacemaker collection

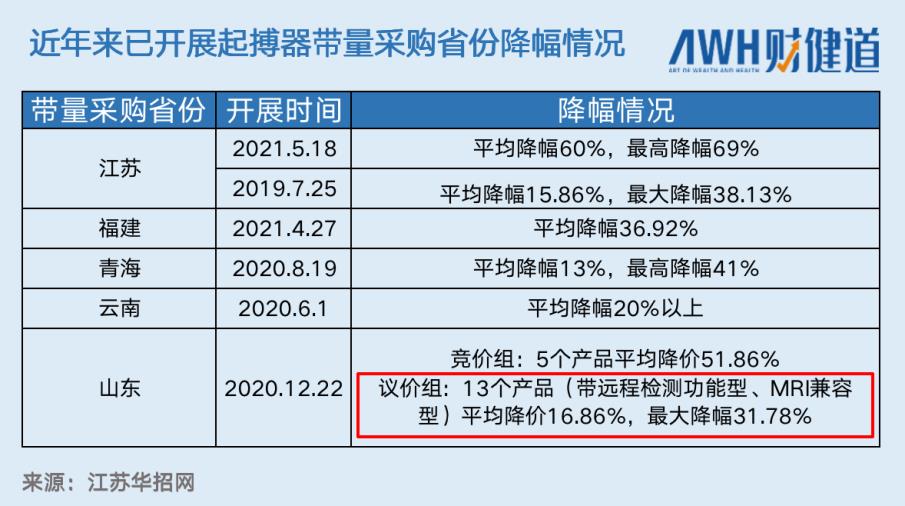

Previously, several inter-provincial alliances have carried out the collection of pacemakers.

In 2019, Jiangsu Province launched the first domestic collection of pacemakers. The average price of this collection decreased by 15.86%, with the highest decrease of 38.18%. Among them, four of the five companies selected were imported, namely Medtronic, Abbott, Baiduoli and Boke, and only one domestic company was selected.

Since then, many provinces have also carried out the collection of pacemakers.

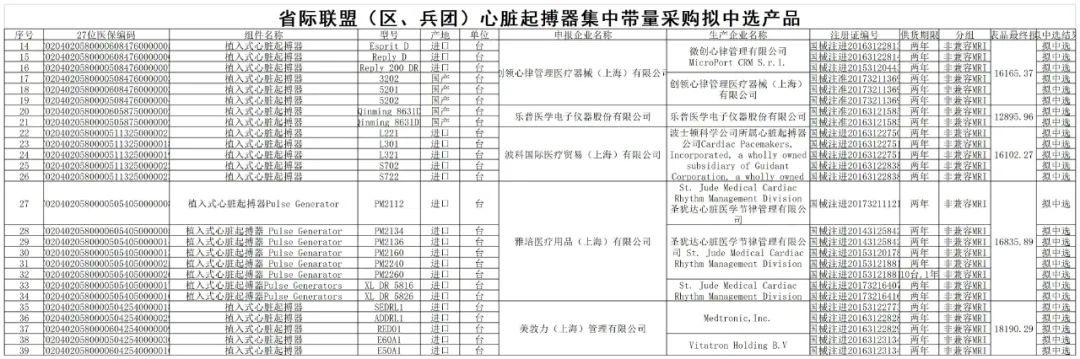

Up to now, the centralized purchase of pacemakers has covered three provinces (cities, districts) in 27 provinces, including Anhui, Jiangsu (two rounds have been carried out), Qinghai, Shandong, Fujian, Zhejiang (under planning), Qujing, Yunnan, Beijing-Tianjin-Hebei "3+N" and Shaanxi seven provinces and one corps, and only Shanghai, Hubei, Shanxi and Guangdong have no arrangements.

Judging from the existing collection results, the highest decline was the second round of cardiac pacemaker collection in Jiangsu Province in May this year, with a decrease of 69%. Although the Shaanxi Alliance has not announced the result of the decline, the average decline of the products to be selected is 57.77% and the highest decline is 78.26% based on the average price of 50,000-60,000 in the past.

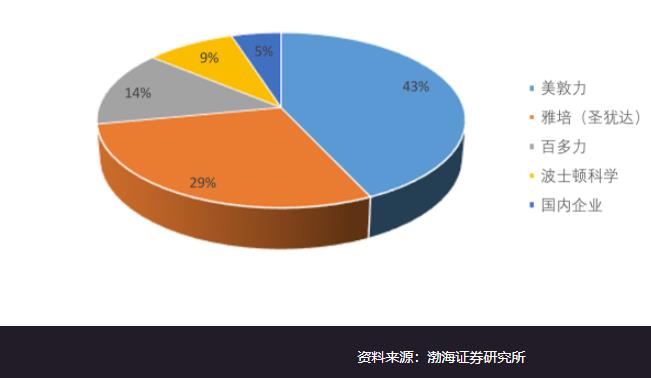

Compared with coronary stents and artificial joints, the price reduction of cardiac pacemakers is very mild. This is not unrelated to the current market structure of pacemakers in China.

The domestic production rate is less than 5%, and it is too early to cut prices drastically.

At present, Medtronic, Abbott and Bocco account for 43.0%, 23.7% and 17.8% of the domestic pacemaker market respectively, and the three giants together account for 84.5% of the domestic market. Together with the second echelon’s Baiduoli and Sorin Group, the market share of imported pacemakers in China reaches 95.7%.

In recent years, the annual implantation of pacemakers has been increasing year after year, and the growth rate is maintained at around 10%. It is expected that about 100,000 pacemakers will be implanted in 2020, and the market scale will reach 4 billion yuan.

With the increasing demand in the market, a few imported enterprises occupy the vast majority of the market share. On the whole, China’s pacemaker market still belongs to the "seller’s market", and it is not realistic to achieve a substantial price reduction.

Looking back at the field of domestic pacemakers, the technology of local enterprises in China is still in the initial stage. If the price of centralized purchasing is too low, the market price of products will be reduced below the research and development cost. If there is no desirable benefit, who else is willing to face the difficulties and conduct independent research and development?

Moreover, unlike other conventional consumables, manual follow-up and maintenance services after implantation account for a large proportion in the cost of pacemakers. Pacemakers will be carried for life after being implanted in human body. Follow-up doctors need to put a special small computer probe on the skin and remotely check whether the pacing system works normally in vitro.

At present, China has not been able to establish a follow-up service technical team. If foreign-funded enterprises lose the election because of their varieties and their profits drop too much, they will change the existing service model and cut off the labor service costs such as follow-up, which will have a huge impact on patients. Based on the above considerations, the bargaining range of centralized mining needs to be more cautious.

Heyihui medical treatment viewpoint

Centralized purchasing is a "double-edged sword". How to use the "price-cutting knife" of the policy to realize the double benefits of price control and industry development is a difficult problem..

Since the beginning of centralized procurement, the fields of artificial joints and coronary stents have experienced an ultra-high decline of up to 80% and 90%, which once made the industry discouraged. At the same time, in the medical field where patients’ health is paramount, the chronic diseases in the bidding field such as "winning the bid at the lowest price" and "bad money driving out good money" are criticized by the industry.

No matter how centralized purchasing develops, its ultimate beneficiary should be the patients. Based on the characteristics of the medical industry, how to grasp the bargaining degree of centralized purchasing really tests the decision-makers’ understanding of the industry and also affects thousands of medical device enterprises.

Source: Heyihui Medical

关于作者